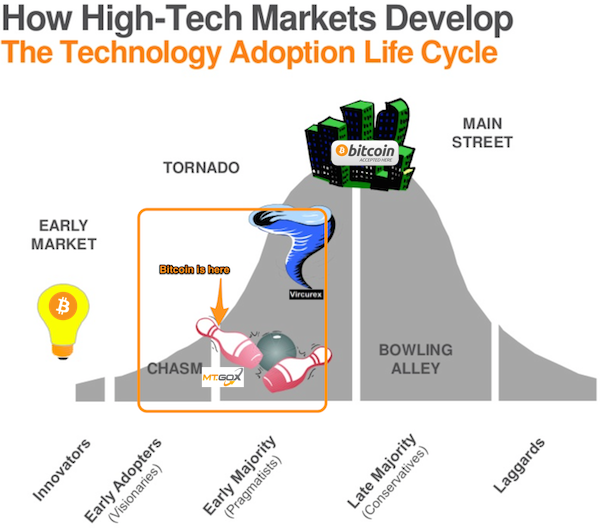

Crossing the Bitcoin chasm

On 2 February (8 weeks ago) I wrote “Ditching BHP + RIO shares for Bitcoin” thanks to an introduction by Mark Andreessons post.

IMAGE: Slideshare : Geoffrey Moore, Crossing the Chasm — What’s New, What’s Not

I’m late to the game, but I thought I’d share what I’ve learned by participating with real dollars. I’ve just closed a tech startup (“a learning experience”), so with time on my hands while I find the next thing, I went all in for 6 weeks to learn by doing. I learn best by full immersion.

I’ve worked with and built multiple tech startups, so I understand the space, but this is a massive chasm to cross. Bitcoin is hard to get your head around and still very complex for the layperson. In the last few weeks I’ve tried to understand what bitcoin is, what the opportunities are, how it functions as a protocol / platform instead of a currency, built a ‘Work for Bitcoin for Freelancers’ site to explore the adoption and found various tools and resources after looking at tens of those available. Here is the distilled version of what I learned.

Six weeks of mayhem

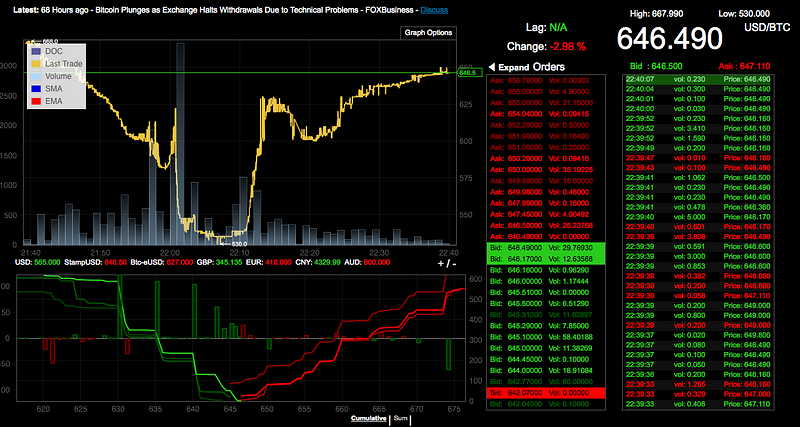

I stumbled into bitcoin during a crazy four weeks. I’ve seen the market crash twice — first when Apple decided to pull the last bitcoin payment app from blockchain.info the same day that My Gox halted withdrawals, causing panic — and a great buying opportunity, and then a few weeks ago when Bitstamp and others followed with the ‘transaction malleability’ issue. Oh, and the money laundering arrest. Welcome, Early Adopters!

What is Bitcoin?

In my view, Bitcoin is a protocol that allows untrusted parties to transact and contract anonymously with near instantaneous payment, anywhere in the world, all publicly visible in a transaction ledger, validated by algorithms.

- Read this first from someone who has invested over $50 Million in bitcoin-related startups (and who also bet on the first revolution, the internet) — Mark Andreessons post on Why Bitcoin Matters.

- Then do this free Udemy online course, Bitcoin or How I Learned to Stop Worrying and Love Crypto

- Then watch this video from Bitcoin 2012 London: Mike Hearn to understand the future opportunities.

Why use Bitcoin now?

Bitcoin is being used now as a simple alternative online payment mechanism, primarily for:

- Fast Peer to peer transactions on the internet

- Low fees

- No banks involved

- Anonymous

I’ve met a few local retailers who are accepting bitcoin, but it’s risky in my view. Very volatile ‘currency’, banks don’t like your business association with bitcoin and tax laws are up in the air, although the US Fed just announced that bitcoin will treated as property and subject to capital gains tax. This will make transacting tricky. Not insurmountable, but challenging. Much respect to these early adopters helping the cause.

The Experiment

To test this, I spent a week hacking together

Qoina, a site to connect Freelancers and Employers that transact in Bitcoin. The results are still out, but so far it’s been a great way to engage with the bitcoin community and feel the growing pains as we figure this out. It’s a perfect use case — technical people, instant payment, trust issues and cross-border transactions.

Getting started.

In Australia, I used Coinjar to convert AU$ into BTC. It’s surprisingly hard to buy bitcoin without using cash. You can purchase Bitcoin from Coinbase and Bitstamp in the USA who seem to be reputable and trustworthy. Merchant Payments are super-easy to accept by using simple code from a service like Coinbase .

The $/BTC exchange rate fluctuates wildly, especially over the last month, so it’s worth monitoring Coinreporting.com or bitstamp.com to get a feel of the pricing before buying.

Hot or Cold?

Your bitcoins are stored in a ‘wallet’. Briefly, a hot wallet is online and riskier than a Cold wallet, which is essentially a code printed out on a piece of paper stored in your safe or placed on a USB drive. Coinjar, as an example, will hold your bitcojns in a hot wallet (online) which is a riskier option than a local (cold) wallet on your offline pc/mac/paper.

The best tools for managing, transacting and storing your bitcoins are Bitcoin-QT, Armoury or Electrum. I prefer Electrum as it’s easier to use than Armoury. Bitcoin-QT takes days to sync and needs 16Gb data storage space, so is not practical for me. I’m using Electrum with my key encrypted with the free AESCrypt as advised by the Udemy course.

It’s a balance between paranoia and accessibility — until I get hacked, of course ;-)

Bitcoin Mining

In short, you’ll spend more on hardware and electricity than you’ll earn. Don’t do it.

Will bitcoin survive and cross the chasm?

Transacting with bitcoin is easy if you’re used to hex keys and QR codes, but I suspect the average merchant or consumer is a long way off using this, so 2014 needs to be the year of the merchant and making bitcoin more friendly in terms of buying some and spending it. We should see a lot of innovation in this area as it’s glaringly obvious as a blocker to broader adoption.

Most of my friends are skeptical and believe that I’m either on drugs or laundering money, which is the unfortunate side effect of the laughable reporting in mainstream media. W.T.F.?

If you ever wonder about the accuracy of the BS that you read, watch how the sensational nonsense gets reported with little or no research while reality is completely ignored.

I’m not sure if bitcoin will survive, but the point is that the effects of bitcoin have already changed the way we think about payment and authentication systems forever. It has impacted legal frameworks across the world, financial institutions, online payments and technology innovation. Bitcoin has created this conversation and we’re testing the status quo, which is good for innovation. Crypto-currency is here to stay and will drive transaction costs down and ease transacting across virtual lines on maps. Of this I’m convinced.

And that is the point of innovation — to challenge the status quo and imagine smarter and more efficient ways of living and engaging with the rest of the planet. Bitcoin is as important as the internet was in 1994 — the domain of techies, geeks, and smart visionaries.

Stay in the conversation

- Follow @aantonop , @pmarca and Mike Hearn. And me, at @LeslieCBarry

- Keep an eye on Reddit/r/Bitcoin

- Watch #bitcoin on Twitter

- bitcointalk.org

- bitcoin wiki

Cool stuff:

- Watch the world currencies flow into BTC in realtime http://fiatleak.com

- Send Bitcoins over Twitter — http://www.tippercoin.com

Quote

“I am a strong supporter of BTC… and yet the only interesting use cases I see for nonfanatics as of 2014 are where they can perceive an advantage over using credit cards: embarrassing transactions (porn, prescription drugs) and high fee transfers (eg remittance to underbanked foreign countries — or buying with Gyft that gives you 3% back).” http://www.reddit.com/user/EuroTrash on Reddit

☞ Please tap or click “♥︎” to recommend this article to others.